Navigating Iran-US Money Transfers: A Comprehensive Guide

Transferring money between Iran and the United States stands as one of the most intricate financial challenges in today's global landscape. Due to a complex web of geopolitical factors, economic sanctions, and stringent regulations, the traditional avenues for sending funds are largely inaccessible. This reality creates significant hurdles for Iranian immigrants, expats, and their families who rely on these transfers for essential support, business, or personal needs. However, despite these formidable obstacles, various alternative solutions and specialized services have emerged, making it possible, though not without careful navigation, to bridge the financial divide between these two nations.

This article aims to demystify the process of how to transfer money from Iran to US, offering a detailed guide through the regulatory maze and highlighting viable options. We'll delve into the specific challenges posed by sanctions, clarify the types of transfers that are legally permissible, and compare the services that currently offer the most reliable and cost-effective solutions. Understanding these nuances is crucial for anyone looking to send or receive funds, ensuring compliance with U.S. laws while successfully completing their transactions.

Table of Contents

- The Complex Landscape of Iran-US Money Transfers

- Why Traditional Banking Fails: Understanding Sanctions

- Navigating the Legalities: OFAC Guidelines and Permitted Transfers

- Alternative Avenues for Sending Money from Iran to US

- Finding the Best Rates and Fees for Your Transfer

- Step-by-Step Considerations Before Transferring

- Key Considerations for a Smooth Transfer

- Future Outlook: What to Expect in 2025 and Beyond

The Complex Landscape of Iran-US Money Transfers

Sending funds from Iran to the United States can be quite challenging, given the complex geopolitical situation between the two countries. For decades, the relationship has been fraught with tension, leading to a series of economic sanctions imposed by the United States. These sanctions are primarily designed to restrict Iran's access to the international financial system, thereby limiting its ability to fund certain activities. While the overarching goal of these sanctions is broad, their practical effect is a significant impediment to even legitimate, personal financial transactions. The very notion of "how to transfer money from Iran to US" immediately brings to light these intricate layers of regulations. It's not merely about finding a service; it's about navigating a legal and financial minefield. The U.S. Treasury Department's Office of Foreign Assets Control (OFAC) is the primary body responsible for administering and enforcing these sanctions. Their guidelines dictate what types of transactions are permissible, under what conditions, and who is authorized to facilitate them. This strict oversight means that individuals and entities must exercise extreme caution and due diligence to ensure compliance, avoiding severe penalties for violations. The inherent difficulty means that direct, straightforward methods commonly used for international transfers simply do not apply in this unique corridor.Why Traditional Banking Fails: Understanding Sanctions

At the heart of the challenge of how to transfer money from Iran to US lies the stark reality that traditional banking channels are largely blocked. Due to the imposition of sanctions by the United States on Iranian banks, it is currently not feasible to conduct direct money transfers through these financial institutions. This means that an individual cannot simply walk into a bank in Tehran and wire money directly to a recipient's account in New York. The financial infrastructure that supports seamless global transfers is severed between these two nations. Moreover, when engaging in currency transfers, there are additional regulations that further complicate matters. Most US banks will not handle a transfer to Iran for you, and popular money transfer providers like Western Union and MoneyGram don’t offer their services to Iran. This is not a matter of choice for these institutions; it's a matter of compliance with U.S. law. The risk of violating sanctions, even inadvertently, is too high for major financial players, leading them to simply avoid this corridor altogether. The problem is that due to prohibitions in the Iranian Transactions Regulations, wire transfers cannot occur directly from an Iranian bank to a U.S. bank. This fundamental block necessitates the exploration of alternative, often less direct, methods for anyone looking to facilitate money movement from Iran. It's a clear indication that the usual financial rails are simply not available for this specific route.Navigating the Legalities: OFAC Guidelines and Permitted Transfers

Transferring money from Iran to the United States, or vice versa, involves navigating a complex web of regulations designed to comply with U.S. sanctions. While the general rule is strict prohibition, there are specific exemptions and general licenses issued by OFAC that permit certain types of transactions. Understanding these nuances is absolutely critical for anyone attempting to move funds. One of the most significant exemptions allows for the transfer of funds that are noncommercial and personal in nature to or from Iran, or for or on behalf of an individual ordinarily resident in Iran. This is crucial for families and individuals. However, there's a vital caveat: this permission does not extend to an individual whose property and interests in property are blocked pursuant to § 560.211, and such transfers are always subject to certain restrictions and limitations. This means that while personal remittances are generally allowed, they must adhere to strict guidelines regarding their purpose and the parties involved. A common scenario where this exemption applies is for inheritances. If it is only money you inherited, then you are permitted to bring that money to the United States and into a U.S. bank account. This specific provision acknowledges the personal and non-commercial nature of inherited funds. However, it's paramount to understand that even though inheritances are very personal transactions and not necessarily related to any business, the United States’ Iran sanctions still apply. This means that while the *purpose* of the transfer might be legitimate, the *method* of transfer must still comply with all regulations. There are several important steps one should take in understanding how sanctions apply to these transactions, the most important being that even though inheritances are very personal transactions, and not related necessarily to any business, the United States’ Iran sanctions still apply. This underscores the need for meticulous documentation and, often, legal counsel to ensure full compliance and avoid any potential legal repercussions. The guidelines governing the transfer of money and capital from Iran to the United States are detailed and require careful interpretation.Alternative Avenues for Sending Money from Iran to US

Given the impossibility of direct bank transfers, individuals looking to transfer money from Iran must seek alternative methods instead of relying on traditional bank transfers. Fortunately, despite the challenges, several money transfer solutions make it possible for Iranian immigrants and expats in the U.S. to reliably receive money from friends and relatives in Iran. These solutions often involve intricate workarounds, leveraging networks of intermediaries or specialized services that operate within the confines of the legal exemptions. The market for these services is dynamic, with companies constantly adapting to regulatory changes and the evolving needs of their clientele. When considering how to transfer money from Iran to US, it's essential to compare trusted money transfer services from Iran to the United States, keeping in mind that what works today might evolve by 2025.Specialist Iranian Money Transfer Services

A significant portion of the alternative landscape is dominated by specialist Iranian money transfer services. These companies have developed unique operational models to navigate the sanctions, often by using a network of agents or by facilitating transfers through third countries. We review specialist Iranian money transfer services as well as major players that use workarounds to deliver remittances to Iran. These services are often specifically designed to cater to the unique needs of the Iranian diaspora, understanding the cultural and logistical nuances involved. One such service that stands out in the provided data is Iranicard. If you’re trying to send money to Iran (or, by extension, receive from Iran through their network), Iranicard can help you. They boast capabilities such as receiving and exchanging almost every currency in Iran within hours. The process typically involves filling an application form, and you’ll receive an email within 1 business day, indicating a relatively streamlined process for such complex transactions. These specialist services often bridge the gap by providing a localized solution in Iran that can then be linked to an international payout mechanism, all while adhering to the permitted transaction types. They essentially act as a crucial intermediary, taking on the burden of navigating the complex regulations.Online Money Transfer Platforms (with Caveats)

While major online money transfer giants like Western Union and MoneyGram are out of the picture for direct Iran-US transfers, some platforms are mentioned in the context of offering competitive rates, often by operating through specific corridors or partnerships. The data suggests that "Wise is the company offering the best price currently on this" for transfers from Iran to the United States. Wise, formerly TransferWise, is one of the most popular online money transfer services due to its transparent exchange rates and fees. However, it's crucial to understand the context here. While Wise is excellent for many international transfers, its direct functionality for Iran-US routes might be limited by the sanctions. The statement "Wise is the company offering the best price currently on this" could refer to situations where a transfer *originates* from a third country where Wise operates, or it might imply a workaround where funds from Iran first reach an intermediate country (perhaps through a specialist service) and then Wise facilitates the onward transfer from that intermediate country to the US. It's unlikely that Wise directly handles transfers originating from Iranian banks due to sanctions. Therefore, while Wise is a valuable tool for international money transfers, its direct utility for *originating* funds from Iran to the US must be thoroughly verified by the user. Another service mentioned is Moneycorp International Money Transfer Services. The data states, "With Moneycorp International Money Transfer Services, you can have the lowest cost for sending US Dollar remittances from Iran." Similar to Wise, this suggests that Moneycorp might offer competitive rates for this corridor, likely through specific, compliant channels or partnerships that circumvent the direct banking prohibitions. It underscores the point that while traditional methods fail, certain players are finding compliant pathways. These platforms offer an attractive option due to their online convenience and often better exchange rates compared to traditional banks, but users must always confirm their specific capabilities for Iran-US transfers and ensure full compliance.Finding the Best Rates and Fees for Your Transfer

When it comes to how to transfer money from Iran to US, finding the best rate and minimizing fees is just as important as finding a compliant method. The cost of services will vary depending on where you are sending money from and the specific service provider. The provided data indicates that "sending via a bank transfer is the payment method that will get you the best price on a transfer from Iran to the United States." This statement, while seemingly contradictory to the earlier discussion about blocked bank channels, likely refers to services that offer rates competitive with what traditional bank transfers *would* offer if they were feasible, or perhaps services that leverage bank-like networks in compliant ways. It emphasizes that competitive pricing is available even within this complex environment. The market for international money transfers is highly competitive, and what might be the cheapest today might not be the cheapest tomorrow. This dynamic nature necessitates constant vigilance and comparison.Understanding Exchange Rates

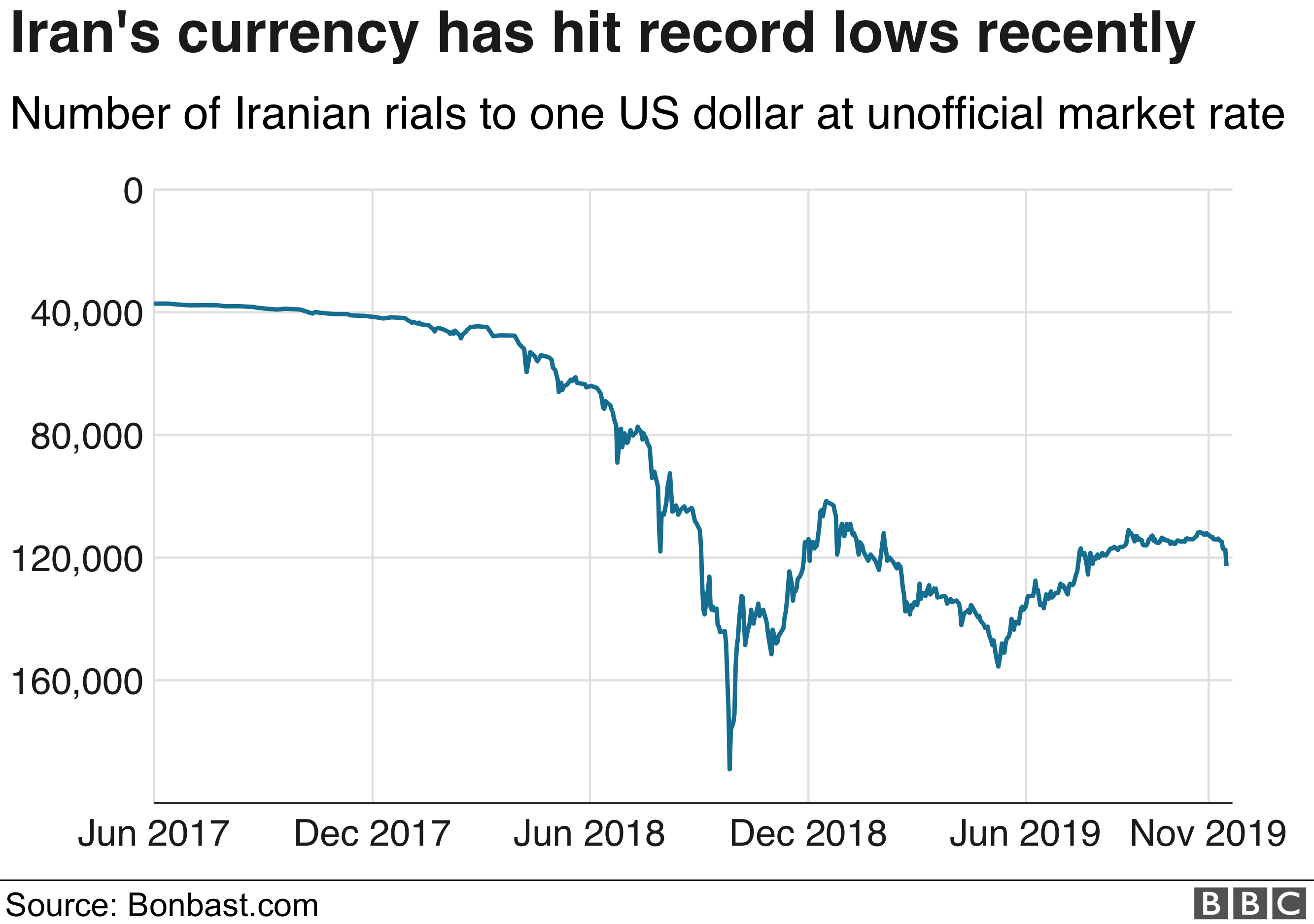

The exchange rate determines how much Iranian Rial (IRR) the recipient will get when you transfer money to Iran (or, conversely, how much USD you'll receive for IRR sent from Iran). For example, today, the average exchange rate between US Dollar and Iranian Rial is approximately 42,125.0001 IRR per USD. However, this is an "average" or "official" rate, and the actual rate offered by money transfer services can vary significantly. These services often apply their own exchange rate markups, which can effectively increase the cost of your transfer even if their stated fees seem low. It is crucial to look beyond just the upfront fee. A service might advertise "low fees," but if their exchange rate is unfavorable, the recipient could end up with significantly less money. Therefore, always compare the *total cost* of the transfer, which includes both the transfer fee and any margin added to the exchange rate. Use online comparison tools where available, and always get a clear quote before initiating a transfer.Hidden Fees and Transparency

Transparency is key when dealing with money transfers, especially for a complex corridor like Iran-US. Some providers might have hidden fees or less-than-transparent exchange rates. This is why services like Wise are popular; they are known for their transparent exchange rates and fees, showing you exactly what you'll pay and what the recipient will receive. When comparing providers, ask for a breakdown of all costs. This includes: * **Upfront transfer fees:** A fixed fee or a percentage of the amount sent. * **Exchange rate markup:** The difference between the interbank rate and the rate offered to you. * **Recipient fees:** Some services or intermediary banks might charge the recipient a fee upon receiving the funds. * **Cash pickup fees:** If the money is picked up in cash, there might be an additional charge. Always aim to find a service that provides a clear, upfront calculation of the total amount the recipient will receive, after all deductions. This helps you ensure you're getting the best value for your money and that there are no unpleasant surprises.Step-by-Step Considerations Before Transferring

Before initiating any transfer, especially when considering how to transfer money from Iran to US, thorough preparation is paramount. As Ms. Yazdanyar highlights in a radio interview, she "gives a thorough guide of the steps you need to take before receiving money from Iran, of the hurdles you may face." This advice is equally applicable when sending funds. 1. **Verify Legality and Purpose:** The most critical step is to ensure the transfer's purpose is entirely legal under U.S. sanctions law. As mentioned, non-commercial, personal transfers (like family support or inheritances) are generally permitted, but commercial transactions or those involving blocked entities are strictly prohibited. You will then need to be very careful about the purpose of the transfer. Misrepresenting the purpose can lead to severe legal consequences for both the sender and the recipient. 2. **Choose a Compliant Service:** Select a money transfer service that explicitly states its ability to handle Iran-US transfers in a compliant manner. Do not rely on services that seem to operate in a legal gray area. Look for companies that are transparent about their processes and regulatory adherence. 3. **Gather Necessary Documentation:** Be prepared to provide extensive documentation. This might include: * Proof of identity for both sender and recipient. * Proof of relationship between sender and recipient. * Documentation supporting the purpose of the transfer (e.g., a will for an inheritance, a declaration of family support). * Source of funds documentation. * Recipient's banking details or preferred payout method. 4. **Understand the Process and Timeline:** Each service will have its own unique process. Some might involve multiple steps, potentially including an initial transfer to an intermediary country before the final leg to the U.S. Understand the estimated time frame for the transfer. While some services claim to facilitate transfers within hours, others might take several business days due to the complexities involved. 5. **Confirm Exchange Rates and Fees:** As discussed, always confirm the exact exchange rate and all associated fees before finalizing the transaction. Ensure there are no hidden costs and that the amount the recipient will receive is clear. 6. **Communicate with Recipient:** Keep the recipient informed about the transfer details, including the service used, the expected arrival time, and any information they might need to receive the funds. This is especially important if the recipient needs to collect cash or provide additional verification. Taking these steps diligently will help mitigate risks and increase the likelihood of a successful and compliant transfer.Key Considerations for a Smooth Transfer

Beyond the initial steps, several ongoing considerations can contribute to a smoother experience when trying to figure out how to transfer money from Iran to US. These factors encompass everything from compliance to convenience and security. 1. **Compliance is Non-Negotiable:** This cannot be stressed enough. Transferring money from Iran to the United States, or vice versa, involves navigating a complex web of regulations designed to comply with U.S. sanctions. Any deviation can lead to severe penalties, including fines and imprisonment. Always prioritize legality over convenience or slightly better rates. If a service seems too good to be true, it probably is. 2. **Security of Funds:** Ensure the service you choose has robust security measures in place to protect your funds and personal data. Look for encryption, secure payment gateways, and a strong reputation for protecting customer information. Given the sensitive nature of these transfers, data security is paramount. 3. **Customer Support:** Evaluate the quality of customer support offered by the service. In case of issues or queries, reliable and responsive customer service can make a significant difference. This is particularly important for complex international transfers where unforeseen delays or complications can arise. 4. **Transfer Limits:** Be aware of any daily, weekly, or monthly transfer limits imposed by the service provider. These limits can vary based on the service, the purpose of the transfer, and the level of verification provided. If you need to send a large sum, you might need to make multiple smaller transfers or seek a service with higher limits. 5. **Payment and Payout Options:** Consider the available payment methods (e.g., bank transfer, debit card, cash) and payout options (e.g., bank deposit, cash pickup). While it is possible to wire money from the US to Iran and have the money reach the recipients in a short time, the reverse might involve different mechanisms. Some services might even allow you to use a bank to write a check to the recipients in their country, though this is less common for Iran-US transfers due to the direct banking prohibitions. Flexibility in these options can make the process more convenient for both sender and receiver. 6. **Review and Feedback:** Before committing to a service, look for independent reviews and feedback from other users, especially those who have used the service for Iran-US transfers. While individual experiences vary, a pattern of positive or negative feedback can be a strong indicator of reliability and service quality. By keeping these considerations in mind, individuals can make more informed decisions and navigate the intricacies of Iran-US money transfers with greater confidence and efficiency.Future Outlook: What to Expect in 2025 and Beyond

The landscape for how to transfer money from Iran to US is not static; it's constantly evolving, primarily influenced by geopolitical developments and changes in sanctions policy. The mention of "compare trusted money transfer services from Iran to the United States in 2025" within the provided data highlights the ongoing need for vigilance and adaptation. This implies that the solutions available today might not be the only ones, or even the best ones, in the near future. The dynamic nature of sanctions means that what is permissible or feasible can change with shifts in diplomatic relations, U.S. foreign policy, or even the interpretation of existing regulations by OFAC. Therefore, anyone regularly involved in these transfers must stay informed about the latest developments. Key aspects to monitor include: * **Changes in Sanctions:** Any easing or tightening of U.S. sanctions on Iran could significantly impact the feasibility and methods of money transfers. A relaxation of sanctions might open up more traditional banking channels, while stricter enforcement could further limit existing workarounds. * **Technological Advancements:** The emergence of new financial technologies, such as blockchain and cryptocurrencies, could theoretically offer new pathways for value transfer. However, these technologies also come with their own regulatory challenges and risks, particularly concerning anti-money laundering (AML) and counter-terrorism financing (CTF) regulations, which are strictly applied to Iran-related transactions. * **Service Provider Adaptations:** Money transfer companies are constantly innovating to meet market demand while remaining compliant. New services may emerge, and existing ones may refine their methods, potentially offering better rates, faster transfers, or more convenient options. This continuous evolution means that today's cheapest money transfer service might not be the cheapest tomorrow. For individuals, this means that ongoing research and comparison will remain essential. Relying on outdated information could lead to using non-compliant methods or incurring unnecessary costs. Subscribing to updates from reputable financial news sources and legal experts specializing in sanctions law can help individuals stay abreast of changes. The journey of how to transfer money from Iran to US is an ongoing one, requiring adaptability and informed decision-making to ensure that funds reach their intended recipients securely and legally.Conclusion

The journey of how to transfer money from Iran to US is undeniably complex, fraught with regulatory hurdles imposed by stringent U.S. sanctions. Traditional banking channels are largely inaccessible, forcing individuals to seek alternative, often specialized, solutions. We've explored the critical role of OFAC guidelines, emphasizing that while direct transfers are prohibited, non-commercial and personal remittances, such as inheritances, are often permissible under specific conditions. Understanding these legal nuances and ensuring the purpose of your transfer is compliant is the foundational step for any successful transaction. Despite the challenges, a landscape of alternative providers has emerged, with specialist Iranian money transfer services and certain online platforms like Wise and Moneycorp offering viable, albeit indirect, pathways. These services navigate the complexities by employing workarounds and adhering to strict compliance protocols. However, it is paramount to compare not just the fees but also the real-time exchange rates, as these significantly impact the final amount received. The dynamic nature of this corridor means that continuous research and vigilance are essential to find the most cost-effective and reliable service. Ultimately, while the process of sending money from Iran to the United States requires meticulous attention to detail, adherence to regulations, and careful selection of service providers, it is indeed possible. We encourage you to thoroughly research any service before committing, verify their compliance, and always prioritize the legality and security of your funds. Have you navigated these complex transfers before? Share your experiences and insights in the comments below to help others on their journey, or explore our other articles for more detailed guidance on international money transfers.- Flag In Iran

- Bomb Iran Lyrics

- Sanctions Of Iran

- Current Iran Leader

- Iran National Soccer Team Schedule

Transfer money from Iran to USA , methods and comparison - سهل پرداخت

Transfer money from Iran to USA , methods and comparison - سهل پرداخت

Us Money To Iran 2024 - Jandy Lindsey