Unraveling Iran's Currency: The Rial And Its Dual Identity

For anyone planning a trip to Iran or considering any form of financial engagement with the country, understanding its currency is paramount. The question, "What is the official currency of Iran?" might seem straightforward, but the answer often leads to a fascinating, albeit sometimes confusing, dual reality. While the Iranian Rial holds the official title, everyday transactions frequently occur in a different, unofficial unit known as the Toman. This unique situation, born from historical context and economic realities, is crucial for travelers, investors, and anyone seeking to grasp the intricacies of Iran's financial landscape.

Navigating the monetary system in Iran requires more than just knowing the name of its legal tender. It demands an appreciation for how a nation's economy, history, and daily life converge to shape its financial practices. From the official ISO codes to the informal street language of money, delving into the Iranian currency reveals a story of resilience, adaptation, and the enduring impact of economic pressures.

Table of Contents

- Understanding Iran's Official Currency: The Iranian Rial (IRR)

- The Rial and the Toman: A Tale of Two Currencies

- Historical Journey of the Iranian Rial

- Navigating Iran's Economic Landscape

- Practical Tips for Travelers and Investors

- The Structure Behind the Currency: Iran's Governance

- The Future of Iran's Currency

Understanding Iran's Official Currency: The Iranian Rial (IRR)

When discussing "what is the official currency of Iran," the definitive answer is the Rial. Officially designated as the Iranian Rial (IRR), it serves as the legal tender for all transactions within the Islamic Republic of Iran. This currency is recognized internationally by its ISO 4217 code, IRR, which is a standard abbreviation used in financial markets worldwide. While some may see it abbreviated as 'Rls' in English texts, the ISO code IRR is the most accurate and widely accepted identifier for Iran's official currency.

- Iran Imam Khomeini

- Dance Of Iran

- Us Launches Strikes On Iran Backed Houthi Targets In Yemen

- Iran President Raisi

- Iran Missiles Attack Israel

What is the Rial?

The Rial, written as ریال in Persian, is the fundamental unit of money in Iran. Unlike many global currencies that have easily recognizable symbols like '$' or '€', the Iranian Rial does not possess a single, universally adopted official symbol. While Iranian standards like ISIRI 820, 2900, and 3342 have defined character codes for its use in digital and mechanical contexts, a common, stylized symbol for the currency is absent in everyday use. This absence sometimes adds to the initial confusion for foreigners trying to identify prices or denominations.

Historically, the Rial was nominally divided into 100 dinars. However, due to the Rial's significantly low value and the pervasive inflation that has affected the Iranian economy for decades, this fractional unit, the dinar, is no longer used in any practical sense. You will not encounter prices or transactions denominated in dinars today, making this subdivision largely a historical footnote.

The Central Bank's Role

The sole authority for issuing and regulating the Iranian Rial rests with the Central Bank of the Islamic Republic of Iran (Bank Markazi Jomhouri Islami Iran). This institution holds the exclusive right to mint coins and print banknotes, ensuring the integrity and supply of Iran's official currency. The Central Bank plays a critical role in managing monetary policy, controlling inflation, and attempting to stabilize the value of the Rial, a task made challenging by various internal and external economic pressures.

The Rial and the Toman: A Tale of Two Currencies

This is where the answer to "what is the official currency of Iran" becomes nuanced. While the Rial is the legal tender, most Iranians conduct their daily financial lives using the Toman. This dual system is a source of considerable confusion for visitors and often leads to misunderstandings if one is not aware of the distinction. It's not that Iran has two different currencies circulating simultaneously in an official capacity; rather, the Toman functions as a unit of account, a shorthand for the Rial, deeply embedded in the cultural and economic fabric of the nation.

Historical Context of the Toman

The Toman (تومان) was, in fact, Iran's official currency until 1932, when it was formally replaced by the Rial. At that time, one Toman was equivalent to ten Rials. Despite its official dethronement, the Toman never truly disappeared from public consciousness. Its continued use is a testament to habit, convenience, and the practical challenges of dealing with a currency that has accumulated many zeros due to inflation. For generations, Iranians have simply found it easier to drop a zero and refer to amounts in Tomans.

The 10:1 Conversion Rule

The conversion between Rial and Toman is straightforward and consistent: 1 Toman equals 10 Rials. This simple ratio is the key to navigating prices in Iran. If a vendor tells you an item costs "23,000 Tomans," you should immediately understand that this translates to 230,000 Rials. Similarly, if a price tag shows "1,000 Tomans," it means 10,000 Rials. This ten-to-one conversion is critical for anyone engaging in transactions, whether buying a souvenir, paying for a taxi, or dining out. It's a common pitfall for tourists to misinterpret prices, potentially leading to overpayment or confusion, highlighting why understanding "what is the official currency of Iran" also means understanding its informal counterpart.

Why the Toman Persists

The persistence of the Toman as a unit of account is primarily a consequence of high inflation and the resulting depreciation of the Rial. As the value of the Rial has plummeted over the years, prices have soared, leading to banknotes with increasingly large denominations. Using Tomans effectively removes a zero from these large numbers, simplifying mental calculations and making transactions quicker. Imagine a product that costs 1,000,000 Rials; it's simply easier to say "100,000 Tomans." This practical efficiency, coupled with deeply ingrained cultural habit, ensures the Toman remains the de facto currency for everyday pricing and conversation, even though the Rial is the official currency of Iran.

Historical Journey of the Iranian Rial

The history of Iran's official currency is marked by periods of reform and reintroduction, reflecting the nation's economic and political evolution. Understanding this timeline provides valuable context to the current state of the Rial and its relationship with the Toman.

Early Introductions

The Rial first made its appearance as a unit of currency in Iran in 1798. At that time, it was introduced as a silver coin, equivalent to 1,250 dinars or one-eighth of a Toman. This early iteration of the Rial coexisted with the Toman, which was then the dominant currency. However, this initial Rial did not last long, eventually being replaced by the Qiran, which was also a subdivision of the Toman.

The 1932 Reintroduction

The modern Iranian Rial, the one we recognize as the official currency of Iran today, was formally reintroduced in 1932. This marked a significant monetary reform where the Rial replaced the Qiran as the national currency, and the Toman was officially relegated to an unofficial unit of account, albeit one that continued to be widely used. This 1932 reintroduction established the Rial as the sole legal tender, a status it has maintained ever since, despite the ongoing public preference for the Toman in daily discourse.

Subdivisions: The Dinar

As mentioned, the Rial is officially divided into 100 dinars. This subdivision, inherited from older monetary systems, is purely theoretical in contemporary Iran. The extreme depreciation of the Rial means that 100 dinars (which would be 1 Rial) holds virtually no purchasing power. Consequently, no coins or banknotes are issued in dinar denominations, and no prices are ever quoted in dinars. The smallest practical unit of currency you will encounter is typically a Rial banknote, usually in thousands or tens of thousands, or more commonly, prices quoted in Tomans.

Navigating Iran's Economic Landscape

The status and value of the Iranian Rial are inextricably linked to Iran's broader economic conditions, which have been significantly shaped by international sanctions, internal policies, and global market dynamics. For anyone interested in "what is the official currency of Iran" from an economic perspective, understanding these factors is crucial.

Currency Depreciation and Inflation

One of the most defining characteristics of the Iranian Rial in recent decades has been its severe depreciation and the accompanying high inflation. The Rial has experienced dramatic drops in value, sometimes losing more than 50% of its value against major international currencies within short periods. This rapid depreciation means that the purchasing power of the Rial erodes quickly, making it challenging for both ordinary citizens and businesses. This continuous devaluation is the primary reason why Iranians often refer to prices in Tomans, as it helps to mentally manage the ever-increasing numerical values.

This inflationary environment is a direct result of several factors, including government fiscal policies, liquidity growth, and the impact of economic sanctions that restrict Iran's access to global markets and international banking systems. The official exchange rates, such as the example of 1€ = 44.69 Rials (as of November 13, 2024, if this were a future date), often differ significantly from the rates available on the open market, further complicating financial transactions and creating a multi-tiered exchange rate system.

The Non-Convertible Nature of the Rial

The Iranian Rial is generally considered a non-convertible currency. This means it is not freely traded on the global foreign exchange market, unlike major currencies such as the US Dollar, Euro, or Japanese Yen. The ability to buy, sell, and exchange Iranian Rials is largely restricted to within Iran's borders or through specific, often regulated, channels internationally. This non-convertibility is a direct consequence of international sanctions and capital controls imposed by the Iranian government to manage its foreign reserves and prevent capital flight. For travelers, this means you cannot easily exchange Rials outside of Iran, and for investors, it poses significant challenges for repatriation of funds and international transactions.

Global Economic Context

For a long time, the US Dollar has been the cornerstone of the world economy, serving as the primary reserve currency and the basis for global exchange rates and commodity quotations. Iran's economy, despite its significant oil and gas reserves, operates largely outside this dollar-centric system due to sanctions. This isolation has forced Iran to develop alternative trading mechanisms and rely more on bilateral agreements, which further impacts the stability and convertibility of the Rial. While global forex markets are open 24 hours a day, five days a week (opening Monday morning in Sydney and closing Friday at 5 PM New York time), the Iranian Rial's participation in these markets is highly limited and controlled.

Practical Tips for Travelers and Investors

Understanding "what is the official currency of Iran" is just the first step. For those planning to visit or engage financially with the country, practical knowledge is paramount. The unique currency situation requires careful preparation and awareness to avoid common pitfalls.

Always Carry Cash

Due to international sanctions, foreign credit and debit cards (Visa, Mastercard, etc.) do not work in Iran. This is one of the most critical pieces of advice for any traveler.

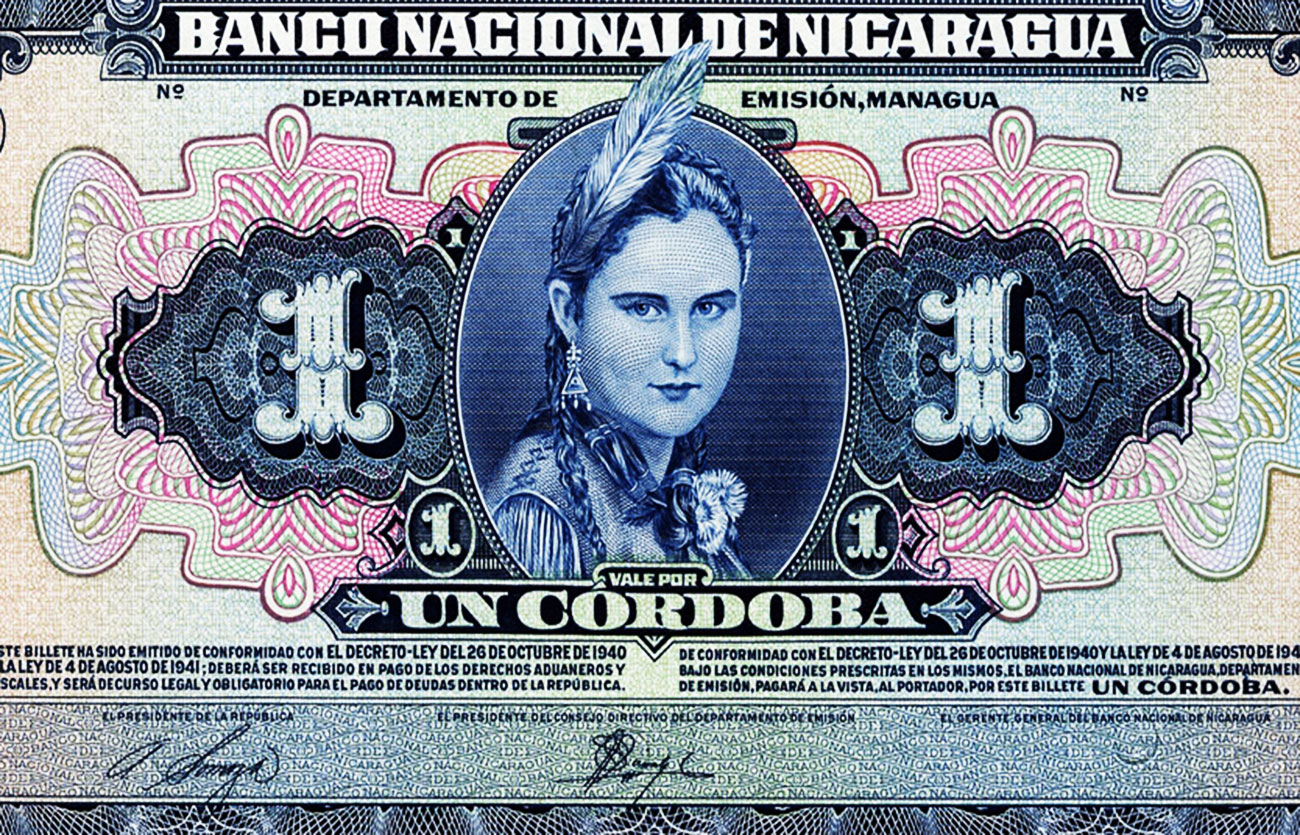

Cuál es la moneda de Nicaragua – Sooluciona

Cuál es la moneda de Argelia – Sooluciona

Cuál es la moneda de Honduras – Sooluciona