Iran's Copper Riches: Unearthing A Global Powerhouse

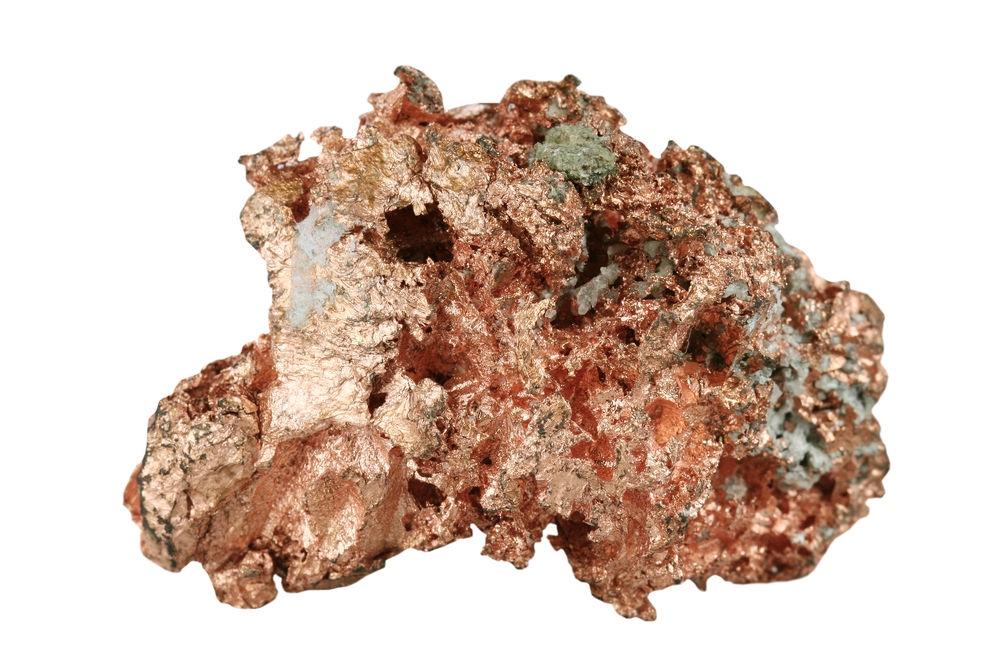

Iran, a nation often highlighted for its rich cultural heritage and strategic geopolitical position, is also quietly emerging as a formidable force in the global metals market, particularly in the realm of copper. The vast and largely untapped potential of its copper mines in Iran represents a significant economic frontier, poised to play a crucial role in the country's future development and global supply chains. With substantial reserves and a concerted effort towards modernization and foreign investment, Iran's copper industry is increasingly drawing the attention of international stakeholders.

This deep dive into Iran's copper sector will explore the historical significance of its mines, the impressive scale of its reserves, current production capabilities, and the strategic initiatives being undertaken to unlock its full potential. From ancient mining sites to modern industrial complexes, Iran's journey in copper is a compelling narrative of geological wealth meeting ambitious economic aspirations.

Table of Contents

- A Legacy Forged in Copper: Historical Roots

- Iran's Copper Reserves: A Global Perspective

- Production and Quality: Meeting International Standards

- The Role of Government and Industry Giants

- Strategic Vision for Copper Industry Growth

- Investment Hotspots and Regional Significance

- Challenges and Opportunities in Iran's Copper Sector

A Legacy Forged in Copper: Historical Roots

The story of copper in Iran is not a recent phenomenon; it stretches back millennia, intertwined with the very fabric of ancient civilizations. Archaeological evidence suggests that the earliest exploitation of copper in the region dates back to prehistoric times. It has been suggested that the oldest copper mine in Iran was Tālmesi, a site believed to have supplied the raw material essential for the furnaces at Sialk (Zāvoš), one of the most important archaeological sites in Iran, dating back to the 6th millennium BCE. This deep historical connection underscores the enduring significance of copper to the Iranian land and its people, a legacy that continues to shape its industrial present.

- Iran President Helicopter Dead

- Main Language In Iran

- Irannuclear Israel

- Dariush Iran

- Iran Us Negotiations

Fast forward to the modern era, the institutionalization of Iran's copper industry began to take shape in the latter half of the 20th century. In 1972 (1351h.), the Sarcheshmeh Copper Mines Joint Stock Co of Kerman was established, marking a pivotal moment in the systematic development of the country's vast copper resources. This initial entity laid the groundwork for what would become a national endeavor. Later, in 1976 (1355h.), it was renamed the National Iranian Copper Industries Company (NICICO), a strategic move to centralize and consolidate all copper mine operations throughout the country. NICICO, abbreviated as NICICO, became the cornerstone of Iran's copper sector, tasked with numerous responsibilities including the extraction and utilization of copper mines across the nation. This evolution from localized operations to a unified national company highlights Iran's long-term commitment to harnessing its copper wealth.

Iran's Copper Reserves: A Global Perspective

When discussing the global landscape of mineral wealth, Iran's position as a significant holder of copper reserves often goes understated. Yet, the data paints a compelling picture of a nation with immense untapped potential, positioning it as a key player in the future of the world's copper supply. The sheer volume and quality of its deposits make Iran an indispensable part of the global copper narrative.

The Scale of Iran's Copper Wealth

The numbers speak volumes about Iran's copper endowment. Presently, there are 10 active copper mines in Iran whose reserves collectively amount to an astonishing 3 billion tons of ore. Within this vast quantity of ore, there is an estimated 30 million tons of copper metal, which comprises a significant 9 percent of the world’s known copper reserves. This places Iran firmly among the top nations in terms of copper resources. Furthermore, recent data from 2024 indicates an even more impressive figure: Iran holds 6% of the world’s total copper reserves, containing a staggering 60 million tons of copper. This updated estimate solidifies its global standing, ranking it sixth worldwide in terms of copper reserves. Such substantial reserves are not merely statistics; they represent a foundational asset for Iran's long-term economic stability and industrial growth, especially as global demand for copper continues to surge due to electrification and technological advancements.

Major Deposits: Sarcheshmeh and Sungun

While Iran boasts numerous copper deposits, two stand out for their immense scale and strategic importance: Sarcheshmeh and Sungun. These two regions are recognized as Iran’s main copper mining regions, hosting some of the largest copper reserves in the country. Sarcheshmeh (سرچشمه) or Sarcheshmeh Copper Complex (Persian: كارخانجات مجتمع مس سرچشمه – Kārkhāneh-ye Mojtame‘-e Mes-e Sar Cheshmeh) is a monumental open-pit copper mine located in the Kerman Province of Iran. It is widely considered to be the second largest copper deposit worldwide, a testament to its geological significance. Based on previous estimates, Iran’s largest copper mine in Sarcheshmeh, situated in the southeast of the country, had a deposit of 1.2 billion metric tons of copper ore with an impressive purity of 0.7%, making it one of the largest mines in the world. Beyond copper, Sarcheshmeh is also known to contain substantial amounts of molybdenum, gold, and other rare metals, adding to its economic value. The mining site itself covers a vast area of 400.00 hectares (988.42 acres), with two distinct surface workings, highlighting the scale of operations.

Sungun, located in northwest Iran, is another cornerstone of the nation's copper wealth. The National Iranian Copper Industries Company (NICICO) recently announced a significant development concerning this mine. In a report released on a Wednesday, NICICO revealed that huge copper deposits had been discovered in Sungun mine after a series of “shining exploration activities” in the area. This discovery underscores the ongoing potential for new findings within Iran's geological landscape, promising to further boost its already impressive reserve figures. Collectively, the country's three major copper mines operated by NICICO—Sarcheshmeh, Sungun, and Miduk—have reported reserves totaling 3.4 billion tonnes, solidifying Iran's position as a global copper powerhouse.

Production and Quality: Meeting International Standards

While the sheer volume of reserves is a strong indicator of potential, actual production and the quality of the output are what truly define a nation's standing in the global metals market. Iran's copper industry has made significant strides in both these areas, steadily increasing its output and consistently delivering high-quality products that meet international benchmarks.

Current Production Landscape

In terms of copper production, Iran has been steadily increasing its output, carving out a notable, albeit still growing, share of the global market. With an annual output of 335,000 tons of copper, Iran accounts for 1.5% of the world’s copper production, ranking it fifteenth globally. This demonstrates a consistent effort to translate its vast reserves into tangible economic output. Data from the World Bureau of Metal Statistics further supports this upward trend, indicating that as of 2020, Iran produced approximately 309.2 thousand metric tons of copper through its mining efforts. The National Iranian Copper Industries Company (NICICO), as the primary operator, plays a crucial role in this production. Its mining operations handle substantial volumes, with NICICO stating it mines 700,000 tons of copper annually. While this figure likely refers to ore or concentrate processed, it highlights the significant operational capacity and the scale of extraction activities undertaken by the company to feed the downstream processing facilities and ultimately contribute to the national copper metal production.

The Purity Advantage

Beyond quantity, the quality of copper concentrate produced in Iran is a significant competitive advantage. Iranian copper concentrate is known for its high purity, often meeting or exceeding international standards. This high purity is a critical factor for buyers in the global market, as it directly impacts the efficiency and cost of further refining processes. The cleaner the concentrate, the less energy and fewer chemicals are required to produce pure copper metal, making Iranian concentrate a desirable commodity. Interestingly, the copper ores from western and central Iran, Afghanistan, and Oman, which have been studied, are rarely associated with significant quantities of tin. The tin contents of these ores are usually low, typically about 10 ppm (0.001%), and in Omani copper ores, specifically, the average is about 1 ppm (0.0001%). This low impurity profile, particularly regarding elements like tin which can be detrimental to copper's properties, further enhances the appeal of Iranian copper concentrate on the international stage. This commitment to quality ensures that Iran's copper products are not just abundant but also highly valued in the global market, strengthening the country's reputation as a reliable supplier.

The Role of Government and Industry Giants

The structure of Iran's mining sector is heavily influenced by state ownership, a characteristic that shapes its development and investment landscape. The government owns 90 percent of all mines and related large industries in Iran, including the vast network of copper mines in Iran. This centralized control allows for strategic planning and large-scale investment, but also necessitates government initiatives to attract external capital and expertise for growth.

At the forefront of the Iranian copper industry is the National Iranian Copper Industries Company (NICICO). As previously mentioned, NICICO is the national powerhouse responsible for the extraction, processing, and development of copper resources across the country. It operates the country’s three major copper mines: Sarcheshmeh, Sungun, and Miduk. These operations are critical to Iran's copper output and its position in the global market. NICICO's comprehensive mandate includes everything from exploration and mining to smelting and refining, making it an integrated entity that manages the entire copper value chain within Iran.

Recognizing the need for further development and technological advancement, the government is actively seeking foreign investment for the expansion of the mining sector. In the steel and copper sectors alone, the government is seeking to raise around US$1.1 billion in foreign financing. This substantial investment target underscores the government's commitment to modernizing and expanding these crucial industries. The influx of foreign capital and technology is seen as vital for enhancing operational efficiency, improving extraction techniques, and expanding production capacities to meet rising global demand.

Beyond NICICO, other entities contribute to the broader mining landscape. The Iranian Babak Copper Company (IBCCo) was recently founded and registered in Tehran, with its asset valued at 10,000,000,000 Iranian Rials. IBCCo operates as a subsidiary of the Middle East Mineral Industries and Mines Development Holding Company (MIDHCO), indicating a layered corporate structure aimed at specialized development within the sector. Such subsidiaries often focus on specific projects, exploration, or niche areas, complementing the large-scale operations of NICICO and contributing to the overall growth of the copper industry.

Strategic Vision for Copper Industry Growth

Iran's leadership recognizes the immense potential of its copper sector as a cornerstone for future economic diversification and growth, particularly in an era of fluctuating oil revenues. To fully capitalize on its vast reserves and enhance its global standing, a comprehensive strategic vision has been outlined, focusing on key areas that promise to revitalize and expand the copper industry.

A study proposing several strategic solutions aimed at revitalizing the copper industry in Iran highlights a multi-pronged approach. These solutions include a comprehensive nationwide exploration plan. This initiative is crucial for identifying new deposits and accurately assessing the full extent of Iran's copper wealth, ensuring long-term sustainability of supply. Given the recent discovery of huge copper deposits in Sungun mine after extensive "shining exploration activities," the emphasis on nationwide exploration is clearly a proactive and fruitful strategy. Such systematic geological surveys can unlock previously unknown reserves, further bolstering Iran's position as a global leader in copper resources.

Another critical aspect of this strategic vision is increased budget allocations for mining activities. Modern mining operations, particularly large-scale endeavors involving complex extraction and processing, require significant capital investment in machinery, technology, infrastructure, and skilled labor. Adequate funding is essential to upgrade existing facilities, implement advanced mining techniques, and ensure environmental compliance. The government's pursuit of around US$1.1 billion in foreign financing for the steel and copper sectors underscores this recognition of capital needs, indicating a clear intent to invest heavily in the industry's future.

Furthermore, a significant strategic shift proposed is towards the privatization of mining operations. While the government currently owns 90 percent of all mines and related large industries, a move towards greater private sector involvement could introduce efficiencies, foster innovation, and attract more diverse forms of investment. Privatization can lead to more agile decision-making, improved management practices, and a stronger focus on market dynamics, ultimately enhancing the competitiveness and productivity of Iran's copper mines in Iran. This shift aligns with broader economic reforms aimed at reducing state control and fostering a more dynamic, market-driven economy.

These strategic solutions are not isolated; they are part of a broader national economic development plan. Experts widely agree that copper reserves could play a major role in Iran’s future economic development plans, especially amid rising demand for the metal in the international markets. As the world transitions towards green energy technologies, electric vehicles, and enhanced digital infrastructure, the demand for copper—a vital component in all these advancements—is projected to grow significantly. Iran, with its substantial reserves and strategic plans, is well-positioned to meet a portion of this growing global demand, transforming its mineral wealth into sustained economic prosperity. This also ties into Iran's ambitious plans for other heavy industries; claimed to be the world’s leading steel producer, Iran is planning to boost production of steel to 55mtpa by 2025, illustrating a holistic approach to industrial growth where copper plays a synergistic role.

Investment Hotspots and Regional Significance

The vast and diverse geography of Iran harbors numerous regions rich in mineral deposits, making certain areas particularly attractive for investment in the copper sector. Identifying these hotspots is crucial for both domestic and foreign investors looking to capitalize on Iran's burgeoning mining industry. The concentration of high-quality, large-scale deposits makes these regions central to Iran's copper production and future growth.

Undoubtedly, Sarcheshmeh stands out as the premier investment hotspot. Home to the largest copper mine in the Middle East and North Africa, Iran's southeastern city of Sarcheshmeh is emerging as a critical area for investment in the lucrative industry. Its status as the second largest copper deposit worldwide, coupled with its significant existing infrastructure and operational history, makes it a prime target for capital injection. The presence of not only copper but also substantial amounts of molybdenum, gold, and other rare metals further enhances its appeal, offering diversified revenue streams for potential investors. The established operational framework of the Sarcheshmeh Copper Complex, managed by NICICO, provides a robust foundation for expansion and technological upgrades, promising high returns on investment.

Beyond Sarcheshmeh, Sungun in northwest Iran is rapidly gaining prominence, especially with the recent announcements of huge new copper deposits discovered after extensive exploration. This discovery signifies that the full extent of Iran's copper wealth is still being uncovered, presenting fresh opportunities for greenfield projects or expansion of existing operations. Sungun's strategic location and proven reserves make it another key area for future investment and development of copper mines in Iran.

While Sarcheshmeh and Sungun are the primary hubs, Iran's copper mining potential extends across various regions. Investors can browse copper mining mines in Iran by region, including Alborz, Ardebil, Chahar Mahall and Bakhtiari. These regions, though perhaps not as extensively developed as Sarcheshmeh or Sungun, represent areas with known copper occurrences and potential for future exploration and development. The government's comprehensive nationwide exploration plan is designed to systematically assess these and other regions, potentially opening up new frontiers for mining activities and attracting investment beyond the established major sites. This broader regional potential underscores the long-term sustainability and growth prospects of Iran's copper industry, offering diverse opportunities for investors with varying risk appetites and strategic objectives.

Challenges and Opportunities in Iran's Copper Sector

Like any major industry in a complex geopolitical landscape, Iran's copper sector faces its share of challenges alongside its immense opportunities. Understanding these dynamics is crucial for a realistic assessment of its future trajectory and for attracting the necessary investment to unlock its full potential.

One of the primary challenges has historically been access to international finance and technology due to sanctions. While the Iranian government is actively seeking foreign investment, the perception of risk and the practicalities of financial transactions can deter some international players. Modern mining requires state-of-the-art equipment, advanced processing technologies, and efficient logistics, areas where foreign collaboration can significantly boost productivity and environmental standards. Furthermore, infrastructure development, particularly in remote mining areas, can be a hurdle, requiring substantial capital for roads, power, and water supply.

However, the opportunities far outweigh these challenges. The sheer scale of Iran's copper reserves is its most significant asset. As global demand for copper continues its upward trajectory—driven by the rapid expansion of renewable energy technologies, electric vehicles, and smart infrastructure—Iran is strategically positioned to become a vital supplier. Its high-purity copper concentrate is a distinct advantage, appealing to global refiners seeking efficient and cost-effective raw materials. The government's explicit policy of seeking foreign investment and its strategic solutions, including increased budget allocations and a potential shift towards privatization, signal a strong commitment to overcoming obstacles and fostering growth. The ongoing nationwide exploration plan promises to uncover even more deposits, ensuring a robust supply pipeline for decades to come.

Moreover, the presence of associated valuable metals like molybdenum and gold in major deposits such as Sarcheshmeh offers additional revenue streams, enhancing the economic viability of mining projects. The established operational expertise of NICICO, with decades of experience in managing large-scale copper operations, provides a stable foundation for new ventures and partnerships. Ultimately, the confluence of vast, high-quality reserves, a supportive government strategy, and a booming global demand for copper positions Iran's copper sector for substantial growth, making its copper mines in Iran a compelling proposition for those looking to invest in the future of global metals.

Conclusion

Iran's copper industry stands at a pivotal juncture, poised to leverage its extraordinary geological wealth to become an even more significant player on the global stage. From its ancient origins at Tālmesi to the modern, expansive operations of Sarcheshmeh and Sungun, the nation's journey in copper has been one of continuous discovery and development. With a staggering 6% of the world's copper reserves in 2024, Iran possesses an undeniable strategic advantage in a world increasingly reliant on this versatile metal for its technological and sustainable future.

The concerted efforts by the National Iranian Copper Industries Company (NICICO) and the Iranian government to attract foreign investment, implement comprehensive exploration plans, and consider privatization initiatives underscore a clear vision for growth. The high purity of Iranian copper concentrate, coupled with its substantial production capacity, positions the country as a reliable and quality supplier to international markets. As global demand for copper continues its upward trajectory, the vast, largely untapped potential of copper mines in Iran represents not just a national asset, but a critical component in meeting the world's future needs.

The journey ahead for Iran's copper sector is one filled with immense promise. As the nation continues to invest in its mining infrastructure and foster international collaborations, its copper riches are set to play a major role in its economic diversification and global integration. We invite you to share your thoughts on the future of Iran's copper industry in the comments below, or explore other articles on our site to delve deeper into the fascinating world of global mining and resource development.

- Us Launches Strikes On Iran Backed Houthi Targets In Yemen

- Persian Iran

- Iran President Helicopter Dead

- Shah Pahlavi Iran

- Iran V Qatar

Copper | Uses, Properties, & Facts | Britannica

Copper Facts, Symbol, Discovery, Properties, Uses

Learning Geology: Copper