Wells Fargo Iran Declaration: Unpacking OFAC, Sanctions, And Your Rights

Have you recently been asked by your bank to sign an "Iran Declaration Form"? If so, you're not alone, and for many, especially those of Iranian heritage, this request from institutions like Wells Fargo can be unsettling and confusing. This form, often presented with little explanation, touches upon complex U.S. sanctions laws and can have significant implications for your banking relationship. Understanding the context, the legal background, and your rights is crucial in navigating this sensitive issue.

The "Wells Fargo Iran Declaration Form" is more than just a piece of paper; it's a direct consequence of stringent U.S. economic sanctions against Iran, and in Wells Fargo's case, a reflection of past compliance failures. This article aims to demystify the form, delve into the history of Wells Fargo's entanglement with sanctions violations, explore the advocacy efforts challenging its use, and provide practical guidance for individuals who encounter it. We will equip you with the knowledge to understand what this means and what you can do.

Table of Contents

- Understanding the Wells Fargo Iran Declaration Form

- The Roots of the Controversy: Wells Fargo's Sanctions Violations

- The Discriminatory Impact: NIAC's Advocacy

- Navigating the Form: Practical Steps for Account Holders

- Defining "Government of Iran": What the Sanctions Mean

- Precautionary Measures for Iranian Americans

- When to Seek Expert Legal Counsel

- The Broader Landscape of U.S. Sanctions

- Conclusion: Empowering Yourself in a Complex Financial World

Understanding the Wells Fargo Iran Declaration Form

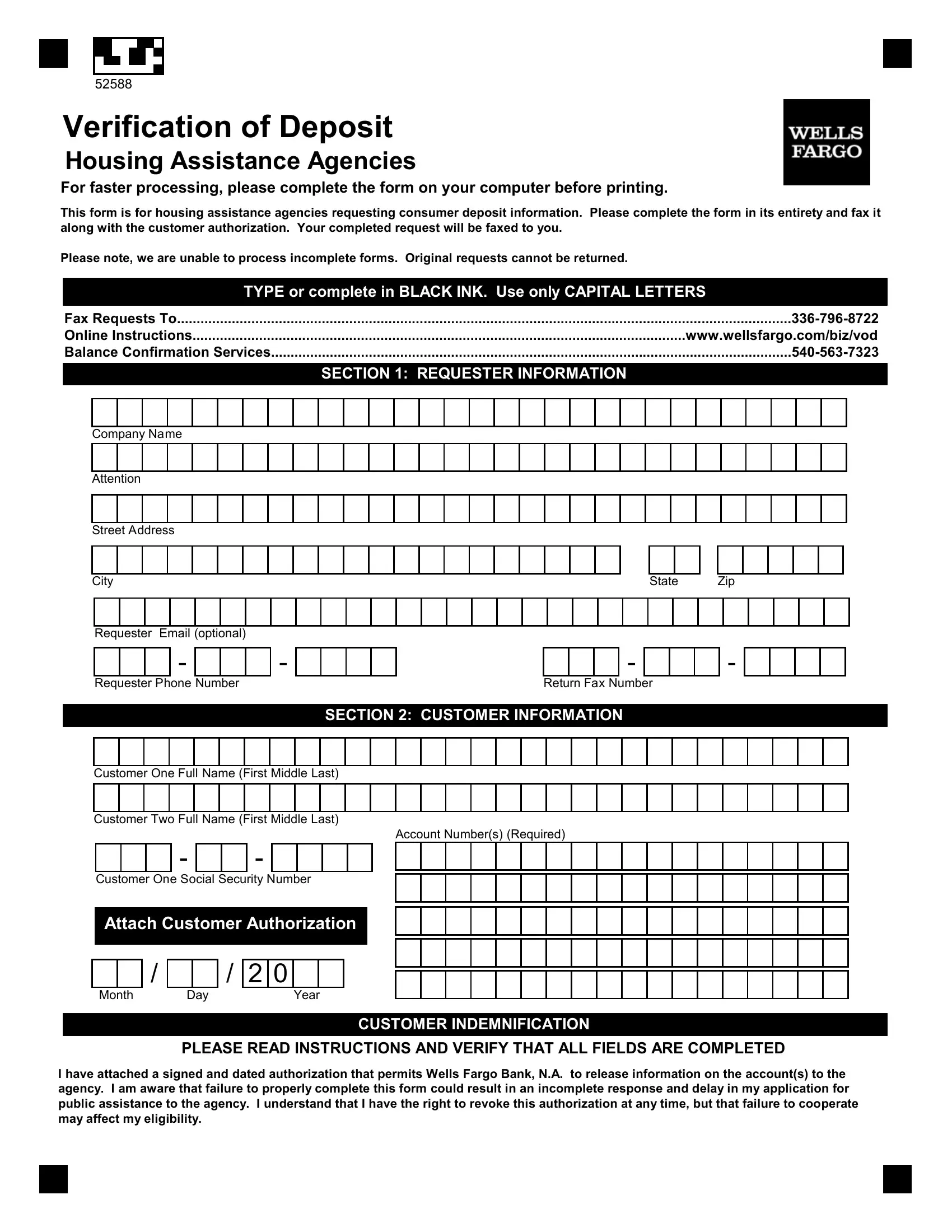

The "Iran Declaration Form" is a document that Wells Fargo, among other financial institutions, may require certain customers to sign. Its primary purpose is to ascertain whether an individual or entity has any direct or indirect ties to the Government of Iran, as defined by U.S. sanctions law. The bank uses this form as part of its due diligence process to ensure compliance with the complex web of regulations administered by the U.S. Department of Treasury’s Office of Foreign Assets Control (OFAC).

- Iran Attack On Us

- Zahedan Iran

- Jimmy Carter And Iran

- What Is Capital City Of Iran

- Currency Of Iran Or Yemen

For many, receiving a request to sign a Wells Fargo Iran Declaration Form can be a source of anxiety. It often comes without clear context, leaving customers wondering about its implications for their accounts, whether it affects their Wells Fargo Business Online® services, Wells Fargo Advisors® Online Services, or other financial dealings with the bank. The form typically asks for declarations under threat of legal action for violating its terms, which can be intimidating and has, in some documented cases, driven prospective customers away from using banking services.

What is the Iran Declaration Form?

At its core, the Wells Fargo Iran Declaration Form is a legal document designed to collect information about a customer's potential connections to Iran. It requires the signatory to affirm that they do not engage in activities or have relationships that would violate U.S. sanctions programs. This includes ensuring that funds are not being transferred to or from entities or individuals associated with the Government of Iran. The form aims to protect the bank from inadvertently facilitating prohibited transactions, thereby avoiding hefty fines and legal repercussions from OFAC.

The wording of such forms can be broad, asking for declarations that cover a wide range of activities. For joint or multiple account holders, banks may require a separate form for each account holder, further complicating the process. The complexity of the questions often necessitates a deep understanding of OFAC regulations, which most laypersons do not possess, leading to confusion and fear of inadvertently making a false declaration.

Who is Asked to Sign It?

While banks are generally required to comply with sanctions, the practice of singling out individuals for an Iran Declaration Form often disproportionately affects those of Iranian heritage or those with perceived connections to Iran. This can include individuals who have received inheritances from family members in Iran, have family residing there, or have engaged in legitimate, non-sanctioned activities that might trigger a bank's internal flags. The request to sign the Wells Fargo Iran Declaration Form is typically an outcome of the bank's internal risk assessment algorithms and compliance protocols, which, while intended to prevent illicit financial activities, can sometimes lead to over-compliance or discriminatory practices.

The issue gained significant public attention when stories emerged of individuals, such as Salehi, whose accounts were closed by Wells Fargo & Co. shortly after an inheritance reached the bank, citing a need to reduce risk. This anecdotal evidence underscores the real-world impact on "a lot of Iranians right now" who face challenges in accessing banking services due to heightened scrutiny and the fear of sanctions violations.

The Roots of the Controversy: Wells Fargo's Sanctions Violations

The increased scrutiny and the emergence of forms like the Wells Fargo Iran Declaration Form are not arbitrary. They are deeply rooted in past compliance failures by major financial institutions, including Wells Fargo itself, that resulted in significant penalties from U.S. regulators. These penalties serve as a stark reminder of the severe consequences of violating sanctions programs, prompting banks to implement more rigorous, albeit sometimes overzealous, compliance measures.

The U.S. Department of Treasury’s Office of Foreign Assets Control (OFAC) is the primary body responsible for administering and enforcing U.S. economic and trade sanctions. When banks fail to comply, OFAC has the authority to levy substantial fines, and these enforcement actions often lead to banks adopting more stringent internal policies to prevent future violations. This historical context is crucial to understanding why the Wells Fargo Iran Declaration Form exists and why banks are so cautious.

A Legacy of Non-Compliance: Wachovia's Eximbills Platform

A significant part of Wells Fargo's history concerning sanctions violations traces back to its predecessor, Wachovia Bank. For approximately seven years, beginning in 2008 and ending in 2015, Wells Fargo and Wachovia provided a foreign bank located in Europe with a software platform known as Eximbills. This platform, designed for trade finance, became the conduit for apparent violations of U.S. sanctions.

On March 30, 2023, OFAC announced a settlement agreement with Wells Fargo for 124 apparent violations of three different sanctions programs: Iran, Syria, and Sudan. All these violations were directly related to the legacy Wachovia bank software platform, Eximbills. This platform, intended for legitimate trade finance, was utilized by the foreign bank to process transactions that violated U.S. sanctions, leading to Wells Fargo's liability.

The Cost of Non-Compliance: Fines and Settlements

The consequences for Wells Fargo were substantial. OFAC deemed these apparent violations "egregious," indicating a high level of culpability. As a result, Wells Fargo agreed to remit $30,000,000 to settle its potential civil liability for these violations. This settlement was part of a broader financial penalty, as the Federal Reserve Board also fined Wells Fargo $67.8 million for oversight failures, bringing the total to pay $97 million for sanctions compliance failures.

These significant fines highlight the immense pressure on financial institutions to maintain robust sanctions compliance programs. The penalties are not just financial; they also carry reputational damage. The experience of paying tens of millions of dollars in fines for past failures directly contributes to the bank's current cautious approach, including the use of tools like the Wells Fargo Iran Declaration Form, to prevent any future missteps and ensure strict adherence to OFAC regulations.

The Discriminatory Impact: NIAC's Advocacy

While banks like Wells Fargo are obligated to comply with U.S. sanctions, the manner in which they implement these compliance measures can sometimes lead to unintended consequences, including what many perceive as discriminatory practices. The National Iranian American Council (NIAC) has been at the forefront of advocating against such practices, particularly concerning the Wells Fargo Iran Declaration Form.

NIAC's letter to Wells Fargo, addressed to Chief Executive Officer Charles W. Scharf, urged the bank to stop requiring its customers of Iranian heritage to sign a discriminatory and burdensome "Iran Declaration." The letter explicitly states, "such a declaration, under the threat of legal action for violating it, is intimidating and has already driven prospective customers away from using your banking services." This highlights the chilling effect these forms have on Iranian Americans seeking to access essential financial services.

The core of NIAC's argument is that while sanctions compliance is necessary, singling out customers based on their heritage or perceived origin, without specific evidence of illicit activity, constitutes discrimination. The burden placed on individuals to prove their non-involvement with sanctioned entities, often under duress, creates an inequitable banking environment. NIAC has and will continue to work with banks and the U.S. government to fully resolve this issue, advocating for more equitable and less discriminatory compliance mechanisms that do not penalize innocent individuals for their ethnicity or national origin.

Navigating the Form: Practical Steps for Account Holders

If you receive a request to complete a Wells Fargo Iran Declaration Form, it's important to approach the situation calmly and strategically. Your immediate actions can significantly impact the outcome of your banking relationship. Here are some practical steps and considerations:

- Understand the Request: Before doing anything, try to understand why you've been asked to sign the form. While the bank might not provide extensive details, the request usually stems from a transaction or account activity that flagged their system.

- Review the Form Carefully: Read every clause and statement on the Wells Fargo Iran Declaration Form thoroughly. Understand what you are being asked to declare. Pay close attention to definitions, especially of terms like "Government of Iran."

- Gather Necessary Information: If the form requires specific details about transactions or relationships, ensure you have accurate information. For joint or multiple account holders, remember that the bank may require a separate form for each account holder, so coordinate accordingly.

- Seek Clarification (Cautiously): If you are unsure about any part of the form, you can seek clarification from Wells Fargo. However, be mindful that any statements you make could be recorded and used. It's often better to consult with an independent expert before engaging in detailed discussions with the bank.

- Consider Your Options: You have the option to complete and submit your completed form to the bank. However, if you are uncomfortable with the declarations or believe they are unjust, you might need to explore other avenues, including legal counsel.

In the meantime, NIAC recommends precautionary measures that Iranians and Iranian Americans can take to help ensure they do not run into this problem. These often include maintaining clear records of all international transactions, avoiding cash transactions for large sums, and being transparent about the source of funds, especially from abroad.

Defining "Government of Iran": What the Sanctions Mean

A critical aspect of understanding the Wells Fargo Iran Declaration Form and U.S. sanctions in general is the precise definition of "Government of Iran" as outlined in OFAC regulations. This definition is not limited to just official state bodies but extends to a broader network of entities and individuals, making compliance particularly complex for individuals with ties to the country.

According to 31 CFR part 561.321, the term “Government of Iran” includes:

- (a) the state and the government of Iran, as well as any political subdivision, agency, or instrumentality thereof;

- (b) any entity owned or controlled directly or indirectly by the foregoing;

- (c) any person to the extent that such person is, or has been, or to the.

This comprehensive definition means that even seemingly innocuous transactions with individuals or businesses in Iran could potentially fall under the umbrella of "Government of Iran" if those entities are owned or controlled by the government, directly or indirectly. This broad scope is why banks are so cautious and why individuals are asked to sign declarations. It’s not just about direct dealings with the Iranian government but also about indirect financial flows that could benefit sanctioned entities.

For individuals, this means that receiving funds from or sending funds to family members in Iran needs careful consideration, especially if those family members work for government-owned enterprises or are otherwise connected to the state apparatus. The complexity of these definitions underscores the need for clarity and, when in doubt, professional advice to ensure compliance and avoid unintended violations of sanctions.

Precautionary Measures for Iranian Americans

Given the heightened scrutiny and the existence of forms like the Wells Fargo Iran Declaration Form, it is prudent for Iranian Americans to take proactive steps to safeguard their financial interests and avoid potential issues with their banking services. While NIAC continues its advocacy to resolve the broader issue, individual preparedness is key.

Here are some precautionary measures:

- Maintain Detailed Records: Keep meticulous records of all international transactions, especially those involving Iran. Document the source of funds, the purpose of transfers, and the identity of the recipient/sender. This can be crucial if your bank questions any activity.

- Understand Permissible Activities: Familiarize yourself with what is and is not permitted under U.S. sanctions. OFAC provides general licenses for certain humanitarian, personal, or educational remittances. Knowing these exceptions can help you navigate legitimate transactions.

- Avoid Third-Party Transfers: Be extremely cautious about receiving or sending funds through third parties, especially if you are unsure of their compliance with sanctions. Direct transfers with clear documentation are generally safer.

- Transparency with Your Bank: While it's important to protect your privacy, being transparent with your bank about the nature of legitimate international transactions can help. For instance, if you are receiving an inheritance, provide documentation from the outset.

- Diversify Banking Relationships: While not always feasible, having accounts with more than one financial institution can provide a fallback if one bank decides to close your account due to perceived risk.

- Stay Informed: Keep abreast of changes in U.S. sanctions policy and any new guidance from OFAC or advocacy groups like NIAC.

These measures can help reduce the likelihood of your account being flagged and minimize the stress associated with requests like the Wells Fargo Iran Declaration Form. It's about demonstrating due diligence and ensuring your financial activities align with U.S. law.

When to Seek Expert Legal Counsel

Navigating the intricacies of U.S. sanctions law and responding to requests like the Wells Fargo Iran Declaration Form can be overwhelming. The potential for legal action or account closure underscores the importance of seeking expert legal counsel, especially when you are uncertain about your obligations or rights.

Yazdanyar Law Offices, for instance, specializes in assisting clients worldwide to comply with and address issues related to the sanctions programs administered by the U.S. Department of Treasury’s Office of Foreign Assets Control (OFAC). Such law firms possess the specialized knowledge required to interpret complex regulations and advise individuals on their specific circumstances.

You should consider consulting with an attorney if:

- You are asked to sign a Wells Fargo Iran Declaration Form and are unsure about any of the declarations it requires.

- You believe the request is discriminatory or unwarranted.

- Your account has been frozen or closed by Wells Fargo or another bank due to alleged sanctions violations.

- You have complex financial dealings involving Iran, such as inheritances, property sales, or business interests, and need to ensure compliance.

- You are concerned about potential legal repercussions for past or future transactions.

An attorney specializing in OFAC sanctions can help you understand the precise meaning of the Wells Fargo Iran Declaration Form, advise you on how to accurately complete it, or represent you in discussions with the bank or regulatory bodies. Their expertise can be invaluable in protecting your financial interests and ensuring you remain compliant with U.S. law, avoiding severe penalties or disruption to your banking services.

The Broader Landscape of U.S. Sanctions

The "Wells Fargo Iran Declaration Form" is a specific manifestation of a much broader and continually evolving landscape of U.S. economic sanctions. These sanctions are powerful foreign policy tools designed to achieve national security and foreign policy objectives, often by targeting specific countries, regimes, individuals, or entities deemed a threat.

Beyond Iran, OFAC administers sanctions programs against numerous other countries and entities, including Syria, Sudan (as seen in Wells Fargo's past violations), Cuba, North Korea, Russia, and various terrorist organizations and narcotics traffickers. Each program has its own set of regulations, prohibitions, and general licenses, making the overall compliance environment incredibly intricate.

Financial institutions like Wells Fargo are on the front lines of enforcing these sanctions. They act as gatekeepers, responsible for monitoring transactions and customer relationships to prevent illicit financial flows that could undermine U.S. foreign policy. The penalties for non-compliance, as demonstrated by Wells Fargo's $30 million settlement with OFAC and the additional $67.8 million fine from the Federal Reserve Board, are designed to ensure that banks take their compliance responsibilities seriously. This stringent enforcement environment means that banks often err on the side of caution, leading to situations where individuals, particularly those from sanctioned or high-risk regions, face increased scrutiny and administrative burdens like the Wells Fargo Iran Declaration Form. Understanding this broader context helps to explain why banks are so vigilant and why navigating international financial transactions requires careful attention to detail and, at times, expert guidance.

Conclusion: Empowering Yourself in a Complex Financial World

The request to sign a Wells Fargo Iran Declaration Form can be a daunting experience, particularly for individuals already navigating the complexities of international ties and U.S. sanctions. As we've explored, this form is a direct consequence of past compliance failures by Wells Fargo, leading to significant fines from OFAC, and the bank's subsequent efforts to bolster its internal controls. While the bank's intent is to comply with strict U.S. sanctions against the Government of Iran, the implementation of such declarations has raised concerns about discrimination and undue burden on individuals of Iranian heritage.

Understanding the history of Wells Fargo's sanctions violations, the precise definition of "Government of Iran," and the ongoing advocacy efforts by organizations like NIAC is crucial for anyone encountering this form. By taking precautionary measures, maintaining meticulous records, and knowing when to seek expert legal counsel, you can empower yourself in what can feel like an opaque and intimidating financial landscape. Remember, your rights as a customer matter, and navigating these complex issues with knowledge and appropriate support is key to protecting your financial well-being. If you have been asked to sign a Wells Fargo Iran Declaration Form, or have concerns about your banking relationship in light of sanctions, don't hesitate to seek professional advice. Share this article to help others understand this critical issue, and explore more resources on our site for further guidance on financial compliance and consumer rights.

Direct Deposit Authorization Form Wells Fargo 51

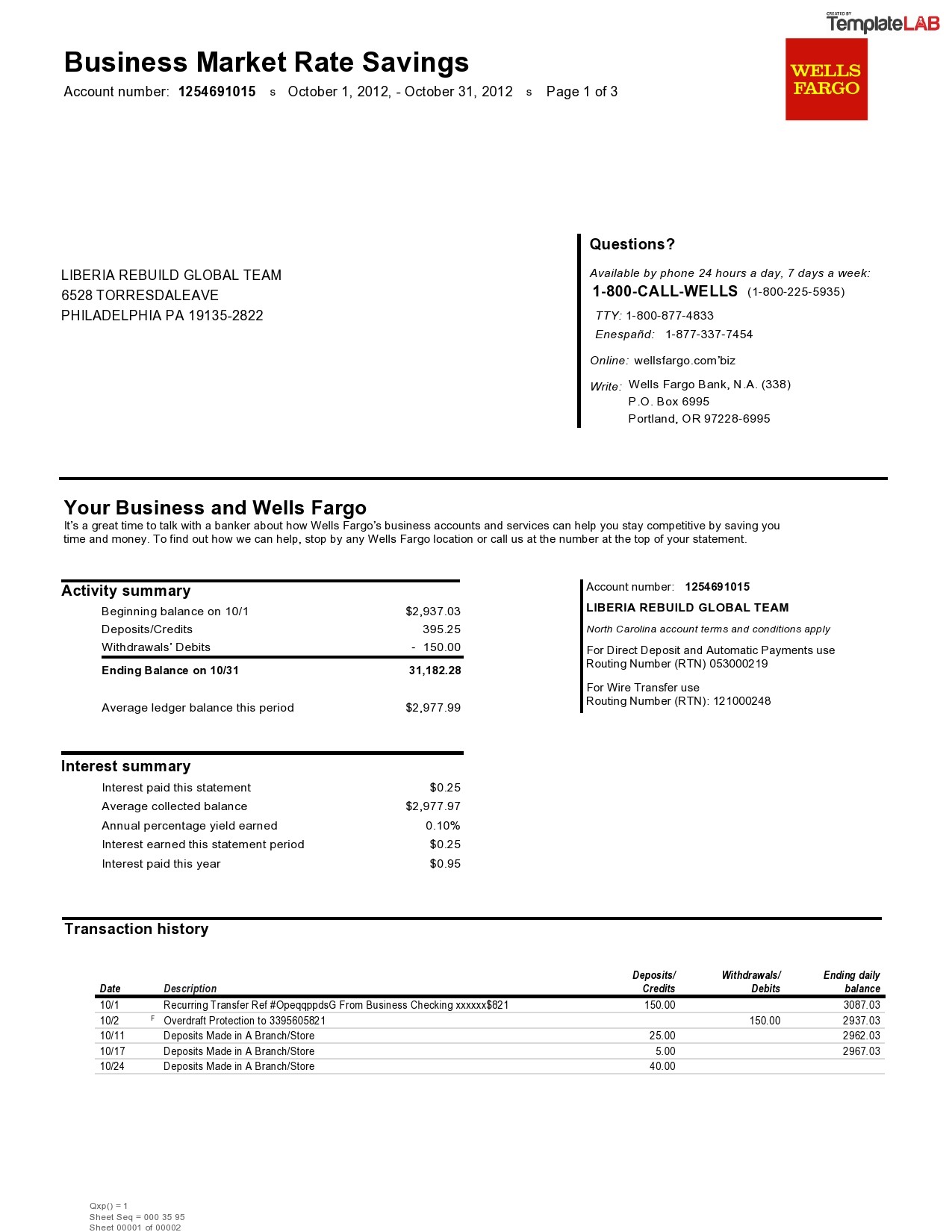

Fake bank statement wells fargo - acetowho

√ Free Fillable Wells Fargo Direct Deposit Form For Work